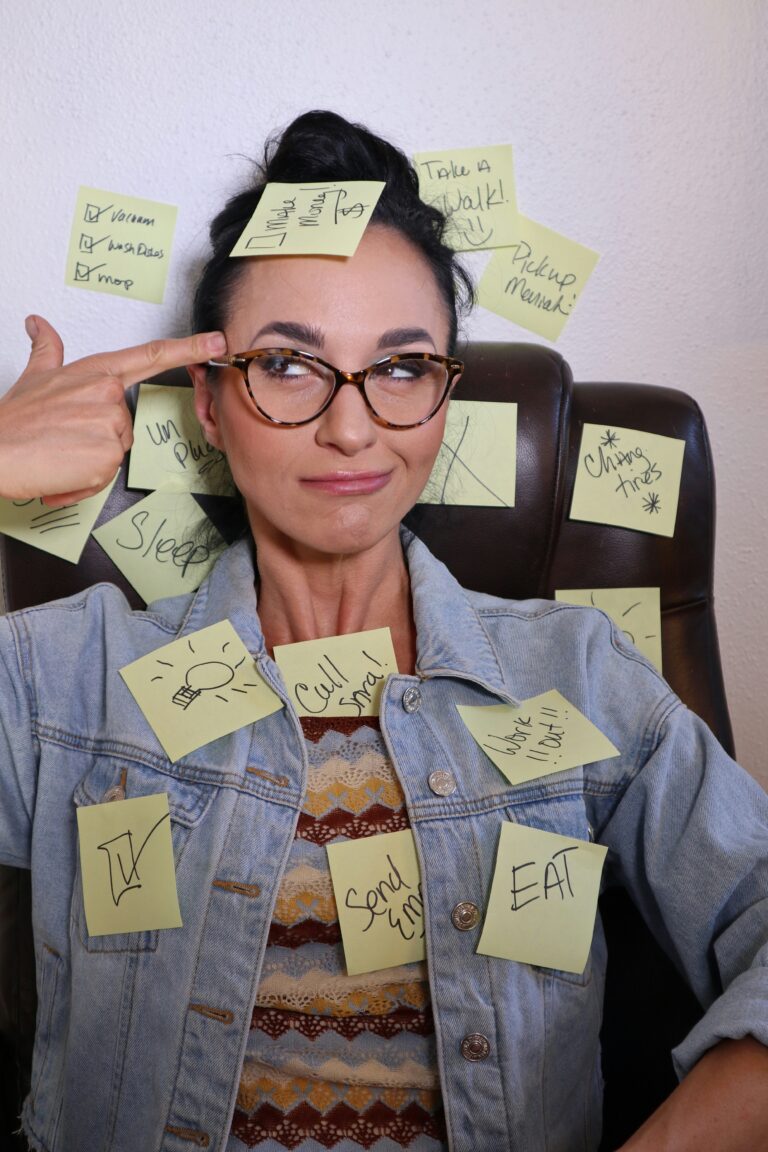

ADHD money mistakes are all about wiring. Here’s how to beat the “ADHD Tax” and finally protect your bank account.

ADHD money mistakes aren’t just about impulse buys! They’re also about solving emotional problems with financial decisions. Mine came dressed as a $1,200 course I didn’t need, a leased car I barely drove, and an apartment I regretted signing for. Each choice gave me temporary relief but long-term costs.

This is the hidden cost many of us live with, also called the ADHD Tax.

Missed bills, impulsive purchases, forgotten subscriptions, and expensive regrets that pile up into financial shame. It’s easy to take our financial errors as lack of common sense, but we are dealing with ADHD brains that struggle to process decisions under stress, urgency, and overwhelm.

In this guide, we’ll explore the most common ADHD financial mistakes, why they happen, and ADHD-friendly strategies to protect your money (including my Money Blocks™ System, shameless plug, that makes managing finances simple and sustainable).

My ADHD Money Wake-Up Call

I wish I could say the website, the car, and the apartment were my only impulsive buys. But, alas, I digress.

There was the car that I leased but did not drive. The job that I took, and knew it was the wrong move. The apartment that was not right for me, but somehow in the moment convinced myself it was a solution. One after another, I was making one bad decision after another. Which, when added up, cost me… well, a lot!

Why dis I keep making these silly decisions? It’s not that I lacked common sense, though it felt like it, but the more I dug (because I always want to understand my patterns) I learned that ADHD money management, or lack of thereof, is a common ADHD occurrence.

Every single one of these decisions had the same hidden structure:

I was trying to solve an emotional problem with a financial solution. The website rebuild was really about feeling professional. The car lease was about feeling successful. ADHD brains crave the dopamine hit of ‘problem solved’ – even when we’re solving the wrong problem.

The Hidden ADHD Tax: Why Financial Mistakes Cost More Than You Think

If you’ve been burned by impulsive choices or expensive regrets, then I hope this post will shed some light on your ADHD money management. What I experienced is part of what’s commonly called the “ADHD tax“ , which is the extra financial and emotional costs that come with living with ADHD.

And it’s not just the occasional impulse purchase. It’s the late fees from forgotten bills, the replacement costs for lost items, the premium prices paid when we’re overwhelmed and need someone else to handle decisions.

Understanding the Real Cost of ADHD Financial Decisions

An article in ADDitude magazine, explains that the ADHD tax shows up in ways that neurotypical financial advice never addresses.

Think of the ADHD tax like a leaky faucet. It doesn’t drain your money all at once . It drips away through little oversights and overwhelm.

- It’s the subscription you forgot about because out of sight means out of mind.

- It’s hiring the first contractor who sounded confident because your brain was too tired to compare options.

- It’s paying for emergency repairs that could have been avoided if routine upkeep didn’t feel like climbing a mountain.

Neurotypical money advice doesn’t talk about these leaks, but for ADHD brains, they’re everywhere.

Another article on the Attention Deficit Disorder Association, ADDA, found that 70–80% of adults with ADHD struggle with impulse control and poor financial decision-making compared to the general population. In fact, adults with ADHD are 2–3 times more likely to experience financial hardship or debt, and nearly 75% report regretting major purchases or commitments they made on impulse.

70–80% of adults with ADHD struggle with impulse control and poor financial decision-making compared to the general population...adults with ADHD are 2–3 times more likely to experience financial hardship or debt, and nearly 75% report regretting major purchases or commitments they made on impulse.

attention deficit disoder association

Why ADHD Brains Struggle with Money Management and Financial Decisions

Here’s why these expensive mistakes happen, and why they’re not character flaws:

Impulsivity & Relief-Seeking

ADHD brains crave fast relief from uncertainty or overwhelm. Saying “yes” quickly feels like reducing stress, but it skips the evaluation step entirely. From the outside, it might look like a simple matter of willpower. But for ADHD brains, the nervous system is wired to seek immediate resolution of uncomfortable feelings, which makes pausing much harder than it sounds.

When someone is pressuring you to decide quickly, your ADHD brain defaults to reducing immediate stress rather than calculating future consequences.

The discomfort of uncertainty feels more intense than it does for neurotypical brains, making quick decisions feel like emotional self-preservation. That “yes” provides instant relief from the mental pressure, even when the logical part of your brain knows you need more time to think.

Time Blindness & Future Discounting

Long-term costs like subscriptions, car payments, and lease penalties feel abstract, while the short-term relief feels concrete. This skews judgment toward “now” decisions. When someone offers a solution to your immediate problem, your ADHD brain struggles to accurately weigh the future implications against the present benefits.

Time blindness also makes it nearly impossible to accurately estimate how long financial commitments will last or how much they’ll truly cost over time. That monthly subscription feels manageable until you realize you’ve been paying it for two years without using the service. The future version of yourself who has to deal with these ongoing costs feels like a different person entirely.

Decision Fatigue & Overwhelm

When you’re faced with too many options, it can feel easier to let someone else decide for you. In my case, it was the web developer, but it could just as easily be a car salesperson or a landlord. The problem is that these people usually don’t have your best financial interests in mind. They are trained to recognize decision fatigue and use it to their advantage.

This vulnerability isn’t about intelligence. It’s about executive function being overwhelmed by too much information, too many choices, or too much pressure to decide quickly. Your working memory can only hold so many variables at once, and when that capacity is exceeded, delegating the decision feels like the only way to escape the mental overload.

So no, it’s not a lack of intelligence. It’s the way ADHD brains are wired to process urgency, stress, and choices.

4 ADHD-Friendly Strategies to Protect Your Finances

At one point, I started to believe I just didn’t have common sense. But that isn’t true. The good news is, “common sense” can be built For ADHD brains, it often looks like adding guardrails that slow down the decision-making process.

Want to make this easier?

The Permission to Achieve planner includes a built-in Decision Parking Lot and Money Blocks™ System so you can stop relying on memory or willpower.

Here are some practical tools you can start using right away:

The 48-Hour Rule for ADHD Impulse Control

No major purchase or contract gets a yes until you’ve waited 48 hours. If someone says “it’s urgent,” that’s your cue to walk away. Urgency is often a sales tactic designed to bypass your prefrontal cortex, which is the part of your brain responsible for executive decisions.

This rule works because it gives your brain time to move from emotional reaction to rational evaluation. Set a phone reminder for 48 hours later to revisit the decision. Often, you’ll find the urgency has completely disappeared.

The $500 Second Opinion Strategy

Anything over $500 requires a second opinion. Call a friend, post in a trusted ADHD group, or even write it down and ask yourself: Can I explain why I need this in one clear sentence? If not, pause.

This strategy works because ADHD brains often struggle with working memory and keeping all the relevant information active while making a decision. A second opinion forces you to externalize and organize your thoughts, which often reveals flaws in the reasoning.

5 Essential Questions Before Any Financial Decision

Before saying yes, ask yourself:

- Is this solving the real problem or just a surface one?

- What will this cost me next month (subscriptions, upkeep, hidden fees)?

- Do I already own something that does 80% of this job?

- What’s the cheapest/lowest-commitment way to test if I even need this?

- What happens if I do nothing?

These questions are designed to counteract the ADHD tendency to focus on immediate benefits while overlooking long-term costs and alternatives.

Creating Your ADHD Decision Parking Lot System

One of the simplest ways to protect yourself from impulsive decisions is to create a Decision Parking Lot. Use a small notebook, or better yet, the built-in section inside the Permission to Achieve Planner. This is where you capture tempting purchases and “solutions” without acting on them immediately.

Revisit your list weekly. Most of the urgency disappears with time, and what’s left are the ideas that truly matter.

This works because it gives your brain a safe place to put ideas without demanding instant action. It satisfies the ADHD need to capture thoughts right now while creating the space for more thoughtful evaluation later.

Building Financial Confidence with ADHD: Reframing ADHD Money Mistakes

If you’ve made expensive mistakes because of ADHD, you’re in good company. The majority of us neurodivergent brains, struggle with ADHD money management, myself included.

Financial mistakes aren’t moral failings when you have ADHD. They’re predictable outcomes of how our brains process decisions, emotions, and money. And the good news is, they can be managed with the right strategies.

As financial therapist Dr. Christine Hargrove explained on the Hyperfocus podcast from Understood, money challenges for ADHD adults often look like impulsive spending, missed payments that tank credit scores, avoidance that leads to late fees, and shame cycles that make it harder to try again. None of this happens because we’re “bad with money.” It happens because ADHD affects executive functions like memory, organization, and follow-through.

Her bottom line: money problems with ADHD are not about laziness or irresponsibility. They’re about finding systems that actually work with our brains — streamlined, realistic, and forgiving enough to stick with, even when life gets messy.

(Source: Hyperfocus podcast, Understood.org)

ADHD-Specific Tools and Resources for Financial Success

The key is finding systems to manage your ADHD financial mistakes. That could mean using simple budgeting apps with visual interfaces, setting up automatic bill pay to prevent late fees, or creating clear boundaries around decision-making. Even small shifts like these can make a dramatic difference.

If you’re tired of money slip-ups, start with the Money Blocks™ System. It organizes finances into four simple categories so ADHD brains can finally feel in control.

Professional support can also make a big impact. Look for financial therapists who specialize in neurodivergent clients or ADHD coaches who can help you stay consistent.

But if therapy is not yet in your budget, I developed the Money Blocks System™. Instead of tracking every penny, it organizes your money into four simple categories so you can see the big picture at a glance. The Money Blocks System™ is designed to be ADHD-friendly: visual, streamlined, and forgiving.

The Bottom Line

Next time you are about to pull the trigger on a big decision, remember: slowing down is not weakness. It is a strategy. It is the difference between handing away another $1,200 and keeping your money where it belongs — with you.

A robust ADHD money management plan, are having systems in place. These systems take practice to implement, but they become second nature over time. Start with one strategy that resonates most with you, and gradually add others as they become habit. Your future self, and your bank account, will thank you.

If you want extra support in building these habits, download my free PAUSE & ACT™ Decision Framework or explore The Money Blocks System™ to help you take control without overwhelm.

Disclaimer: This content is for informational purposes only and is not intended as medical advice. Always consult with healthcare professionals regarding ADHD symptoms and treatment options.

Citations & Further Reading

- ADDitude Magazine: ADHD Tax: Seeking Financial Wellness After Money Problems

- ADDA: ADHD-Friendly Financial Management

- Understood.org: ADHD Money Problems: Financial Therapy

- Barkley, R.A. (2010). ADHD in Adults: What the Science Says

- University of Groningen (2021). Financial decision-making in adults with ADHD

- CHADD: Managing Money and ADHD resources