Raise your hand if this sounds familiar:

You signed up for a 7-day trial, fully intending to cancel before it ended—you even put it on your calendar. But life happened, you forgot, and now you’re staring at a $339 charge, often called the ADHD tax (Okay, maybe that one’s just me).

Or maybe this hits closer to home: you once again discovered a moldy container of berries at the back of your fridge. Your credit card just hit you with another $40 late fee. And somehow, you’ve already lost your third pair of AirPods this year—not counting the ones that are still MIA somewhere in your house.

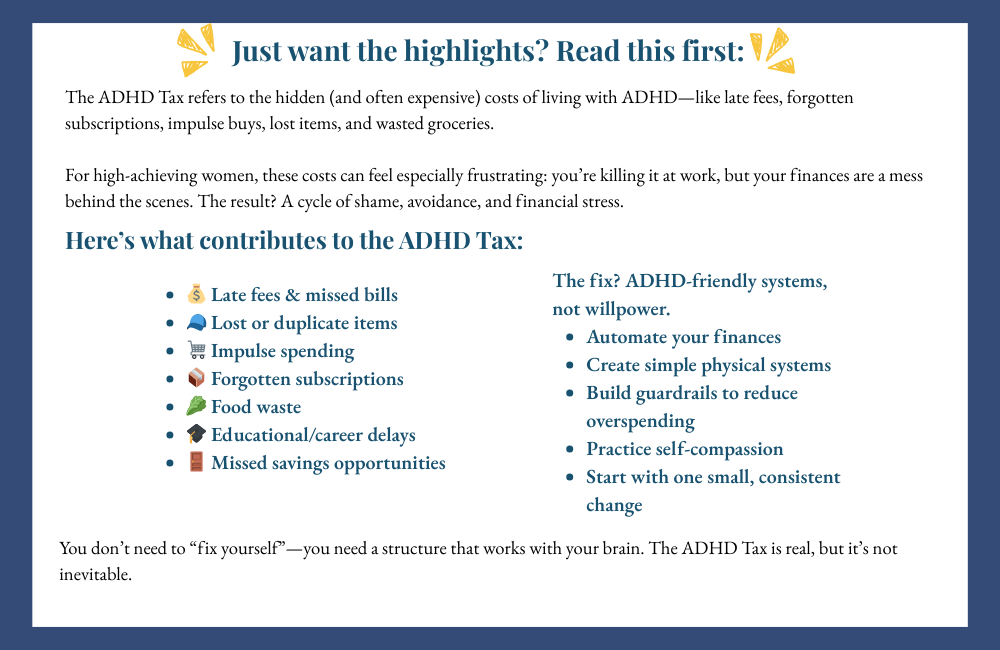

Welcome to the “ADHD Tax”—the hidden, frustrating, and very real financial costs of living with ADHD.

What Is the ADHD Tax?

The ADHD Tax isn’t a formal financial term or a government levy. It’s a phrase used to describe the extra expenses people with ADHD often face as a direct result of their symptoms—things like late fees from forgetfulness, impulsive purchases, or replacing items lost in the chaos of everyday life.

For high-achieving women with ADHD, this can be especially frustrating. You might thrive at work, lead teams, or manage big projects—yet still find yourself struggling with “simple” tasks like paying bills on time or sticking to a budget. The gap between your professional capability and your personal financial challenges can create more than just monetary stress—it often brings guilt, shame, and a tendency to avoid money altogether.

The Most Common Forms of the ADHD Tax

1. Late Fees and Penalties

Late fees have a way of sneaking in from every direction—your phone provider, the utility company, your landlord, your kids’ school, or even your own student loans. You meant to pay it. You thought you paid it. But the reminder got buried, or the task slipped through the cracks—and now you’re being charged again.

Individually, these fees might seem minor. But over time, they snowball—quietly draining money that could be going toward your savings, a vacation, or that business you’ve been dreaming about starting. It’s not that you’re careless. It’s that your brain is juggling a thousand things and sometimes the basics fall through.

2. Replacement Costs for Lost Items

From dropping your phone in the toilet to replacing yet another lost charger, the cost of misplaced or damaged items adds up quickly. People with ADHD often buy duplicates—not because we’re irresponsible, but because we’re juggling a million details at once.

We might repurchase something we already own simply because we can’t find the original or forgot we bought it in the first place. It’s frustrating, it’s expensive, and it slowly chips away at our sense of control.

3. Impulse Purchases

Impulsivity is a hallmark ADHD trait—and it doesn’t stop at words or decisions. It often shows up in our spending. People with ADHD are more prone to impulse purchases, sometimes even beyond their means.

You might splurge on clothes you don’t need, dive into a new hobby with all the gear (only to lose interest weeks later), or make a big unplanned purchase that leaves your budget gasping. These moments offer a quick hit of excitement—but they often come with long-term financial regret.

4. Wasted Subscriptions and Services

Subscription traps are one of the sneakiest forms of the ADHD tax. You sign up for a free trial thinking, I’ll cancel before they charge me—no problem. Maybe you even add it to your calendar or set a reminder. But when the alert pops up, it’s during a meeting, or you’re on the train, or just too overwhelmed to deal with it.

Next thing you know, you’ve been charged for another month—or worse, an annual plan for something you barely used. Streaming services, apps, fitness memberships, meal kits—they all quietly pile on. These small “oops” moments don’t feel like much at the time, but over the course of a year, they can drain hundreds from your account without you even realizing.

5. Food Waste

Another painfully common version of the ADHD Tax? The $6 peaches you were so excited about—now rotten in the back of your fridge. Or that bundle of fresh vegetables that seemed like the start of a new healthy era… now melting into mush in the crisper drawer.

It’s not that you don’t want to eat well. It’s that, in the rush of daily life, perishable food becomes one more thing to track—and often one of the first things to slip. The waste adds up—not just in dollars, but in frustration and guilt every time you throw away good intentions along with spoiled produce.

6. Career and Educational Costs

The ADHD Tax doesn’t just show up in day-to-day spending—it can impact your lifetime earnings. Research shows that adults with ADHD earn about 17% less than their neurotypical peers. Over the course of a career, that gap can mean hundreds of thousands of dollars lost.

And it’s not always due to job performance—it often starts earlier. Maybe you’ve signed up for courses you never finished, missed deadlines that tanked your grade, or dropped out of programs after a hyperfocus phase fizzled out. Those extra semesters, failed classes, or abandoned degrees come with a financial cost that’s easy to overlook—but it stacks up.

7. Missed Opportunities for Savings

Then there’s the money you could have saved—but didn’t. People with ADHD often forget to use coupons, submit reimbursement forms, or take advantage of benefits their jobs already offer. It’s not that the opportunities aren’t there—it’s that they require follow-through, paperwork, or remembering to act at just the right time.

You might miss out on tax deductions you qualify for, skip open enrollment deadlines, or never get around to claiming that $75 wellness reimbursement. Over time, these unclaimed savings quietly pile up into a different kind of ADHD tax—the kind that hides in missed opportunities.

The Emotional Cost

The financial toll of ADHD is real—but the emotional cost can cut even deeper. Every late fee, forgotten bill, or impulse purchase can trigger a wave of shame and negative self-talk. And we find ourselves with that all too familiar feeling like you should have it together by now.

For high-achieving women with ADHD, the pressure is even heavier. You lead teams, hit deadlines, hold it down at work—but behind the scenes, your finances feel chaotic. The clutter, the unopened bills, the budget you swore you’d stick to… it can all feel like evidence that you’re failing at something everyone else seems to handle with ease.

And so the cycle begins: financial mistakes lead to shame, shame leads to avoidance, and avoidance leads to more mistakes. It’s exhausting—and deeply personal.

Solution #1: Create Structural Safeguards

The most effective way to reduce the ADHD Tax is to create systems that prevent the tax from being levied in the first place:

Automation Is Your Best Friend

- Set up automatic payments for all recurring bills to eliminate late fees

- Use automatic transfers to savings accounts on payday before you can spend the money

- Enable balance alerts on your accounts to prevent overdrafts

- Use subscription tracking apps like Truebill or Bobby to identify and cancel unused services

Physical Organization Systems

- Create a dedicated “home” for frequently lost items like keys, wallet, and phone

- Use visual cues and reminders in high-traffic areas of your home

- Implement a digital organization system for important documents

- Consider tracking devices like Tile or AirTags for valuable items you tend to misplace

Financial Guardrails

- Implement a 48-hour rule for purchases over a certain amount

- Use cash envelopes for categories where you tend to overspend

- Create separate accounts for different purposes (bills, spending, saving)

- Remove shopping apps from your phone to reduce impulse purchases

Solution #2: Reframe and Reduce Financial Shame

Addressing the emotional aspects of the ADHD Tax is equally important for creating lasting change:

Practice Financial Self-Compassion

- Recognize the neurobiological basis of your financial challenges

- Separate your worth from your financial mistakes

- Acknowledge your strengths in other areas of life

- Use kind, supportive language when discussing finances with yourself

Connect with Others Who Understand

One of the most powerful ways to reduce the emotional weight of the ADHD Tax is to talk about it—out loud, and with people who get it. Sharing your ADHD tax defeats and triumphs in support groups can dissolve the shame and replace it with solidarity, humor, and real strategies that actually work.

You’re not the only one who’s missed a payment, bought the same thing twice, or paid late fees on a subscription you didn’t even use. Connecting with others who’ve been there can help you feel less alone—and way more equipped.

Look for ADHD-specific financial support groups online, or check out organizations like ADDA (Attention Deficit Disorder Association) and CHADD (Children and Adults with Attention-Deficit/Hyperactivity Disorder). Sometimes the best systems are the ones we borrow from people who’ve walked the same path, or join the Reset and Realign community where we can connect on similar challenges.

Start with Small Changes

Start by asking yourself: Where am I paying the ADHD Tax most often? Is it spoiled groceries? Lost items? Late fees? Forgotten subscriptions?

You don’t need a total financial overhaul. You just need one small, consistent shift. Choose the area that’s costing you the most—financially or emotionally—and build a single system to catch it before it snowballs. Maybe that’s setting a weekly “fridge reset” reminder, designating a home for your keys and tech, or adding a 15-minute money check-in every Friday.

Small steps, taken consistently, are how you build a system that sticks. Not perfect. Just protective.

Educate Partners and Family

Sometimes, the hardest part of the ADHD Tax isn’t the money—it’s the misunderstanding that comes with it. Partners, family members, or friends might see the missed payments or impulse buys and assume it’s carelessness. But these patterns aren’t character flaws—they’re symptoms.

Helping the people close to you understand that your financial struggles are directly linked to ADHD can ease tension and build empathy. When loved ones understand why these challenges happen, conversations about money become less about blame—and more about support.

You don’t have to explain every detail. Just letting them know, “This is something I’m actively working on, and it’s part of how my brain functions,” can go a long way in reducing friction and building connections.

Start Today: Your ADHD Tax Reduction Plan

- Identify your largest ADHD Tax category – Track for one week to see where your symptoms are costing you the most

- Implement one structural safeguard – Choose the simplest, highest-impact system change you can make immediately

- Practice financial self-compassion – Replace one negative financial thought with a more supportive perspective

- Connect with support – Find an ADHD financial support group or coach who understands your unique challenges

Remember, reducing the ADHD Tax isn’t about fixing yourself—it’s about designing systems that work with your brain, not against it. When you start building those small, intentional habits, you reclaim your time, energy, and money—and redirect them toward the things that truly matter to you.

What’s the biggest ADHD Tax expense you’ve faced? Share it in the comments below—you’re not alone, and your story might help someone else feel seen too.